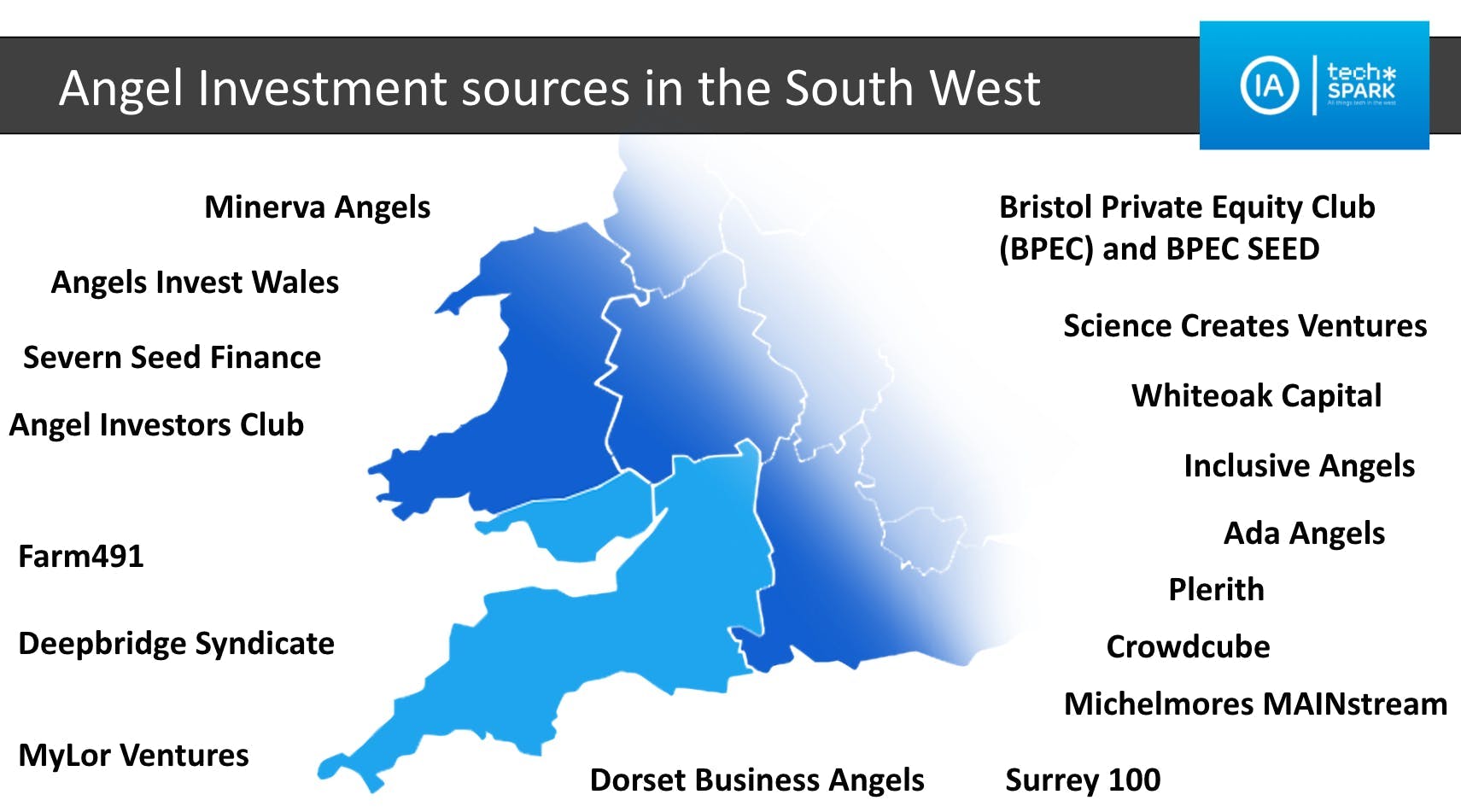

Early stage funding for startups in the South West

With more and more people turning to entrepreneurship, the topic of access to funding and finance has never been hotter. As the host and convenor of the Quarterly Investment Briefing between 2017 and 2023, I saw a gradual shift in the volume of people seeking equity funding for early-stage businesses. With that, I have also seen some developments in the angel investment ecosystem. So I thought I’d put finger to keyboard and share a round-up of all things angel investment - for those seeking funding and for those contemplating starting a group or syndicate of their own - it’s certainly a continued area of need for the region.

What is an angel investor?

A high net worth individual or ultra high net worth individual who has decided to invest a proportion of their wealth into high risk business ventures. Angel investors will look to fund businesses at different stages of development and may do so independently, through a crowdfunding platform, through their corporate financier, or through a group or syndicate.

Is angel funding right for you?

First, think seriously about whether your business is suitable for angel investors and whether you are committed to building a company that will deliver the kind of returns a venture capital investor would want to see. Your investors’ expectations will vary depending on a host of different factors but most angel investors will have a portfolio of investments and a high degree of ambition for your business exit - they’re only going to invest if you can convince them you’ve got the team, potential market, and experience required.

Many experts will recommend that you fund your initial development and growth through bootstrapping, ‘gifts’ or loans from friends and family, grant funding or debt/loans BEFORE you consider equity funding. After all, with equity you are selling a stake in your business and in most cases, a portion of the control - unlike any of the other options. Anecdotally, I regularly hear founders say that they spend up to 70% of their time finding, engaging and courting investors. This time spent away from the business in the early stages can have a significant impact on traction and profitability or progress.

In the UK, most angel investors will expect you to have made some traction and in doing so demonstrated the potential for your business with evidence of the market and the product market fit to help reduce the risk prior to their investment. They will often require you to show what investment you have already made in the business - have you funded it yourself? Have you engaged friends and family? Have you utilised Innovate UK funding (or other grant funds)? This is in stark contrast with the USA where venture capital is much more freely available, and investors will take far greater risks with their money at earlier stages. In the UK, there’s no need to consider ‘institutional’ venture capital investors until you have achieved a few milestones in the business development.

Where can you find the angels?

Your best bet is to start with your own network to find angel investors - who do you know that might be interested in your proposition? Who do they know? Remember that angel investors might work independently or as part of a group or syndicate.

After you have stretched your own network, you could:

- Search the directory of angel groups on the UKBAA website: ukbaa.org.uk/services-for-entrepreneurs/contact-investors/search-the-ukbaa-database/. You might want to review AngelList too.

- Research your peers and competitors via startup directories (Crunchbase, Owler, Open Corporates, Beauhurst) to see who has funded them. You could also take a look at their board of directors to see who has invested. Identify their investors and approach them. Think about who has exited a startup in a relevant industry and might be interested in your business. Engage people as advisors in the hope they might invest.

- Join an incubator or accelerator - these organisations usually have their own little black book of investors and will be able to help you become ‘pitch ready’ and ‘investor ready.’

Local Groups and Syndicates:

Angel Investors Bristol (AIS) - a Bristol-based angel group with a strategic focus on investments ranging from £50,000 to £500,000, qualifying for the Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS), they provide early-stage startups with the vital capital and expertise they need to flourish. angelinvestorsbristol.co.uk/

Michelmores Mainstream - a network for business angel investors, has been established by Michelmores, and is registered with the UK Business Angels Association (UKBAA). michelmores.com/mainstream

Inclusive Angels - a syndicate of early-stage angel investors from diverse backgrounds committed to investing capital into great founders. Their objective is to democratize angel investing by providing a platform for under-represented investors to make investments, develop their track record and show skin in the game. inclusiveangels.com

Dorset Business Angels - dorsetbusinessangels.co.uk

Other active angel groups/funds locally include:

- Minerva Angels - cover multiple regions - minerva.uk.net

- Surrey 100 - surrey100club.co.uk

- Cool Ventures - coolventures.co.uk

- QantX also do some earlier stage deals - https://qantx.co.uk/

- Severn Seed Finance - severnseedfinance.com

- Deepbridge Syndicate - deepbridgecapital.com/products/deepbridge-syndicate

- Angels invest Wales - developmentbank.wales/other-services/angels-invest-wales

- There are a small number of ‘micro VCs’ who will consider investing in a round less than £500k - take a look at Startup Funding Club, Concept Ventures, Ada Ventures, and Newable.

- You could also research ‘family offices’ that may be interested in your sector.

For founders from diverse groups, you could also check out Rocketmakers recent blog about funding options tailored to those underrepresented groups: rocketmakers.com/blog/seven-resources-for-diverse-start-ups-looking-for-investment

If you are currently raising an investment round, you might like to take a look at the support provided by the Investment Activator Programme run by our friends at techSPARK. This program includes SIlicon Gorge (an investment competition), Pitch Me events (to rehearse and receive feedback on a pitch), and much more.

Other useful links:

Alternative Business Funding: alternativebusinessfunding.co.uk British Business Bank Finance Hub: british-business-bank.co.uk/finance-hub

Founder Catalyst is a platform platform that quickly and professionally creates all of the legal paperwork and helps manage investor engagement.

Focused for Business helps to demystify the investment process, break down barriers, and create a level playing field. They have helped companies raise in excess of £20m. They provide the tools and techniques you need to encourage investors to back your business.

7 Deadly Pitch Deck Sins, According To Ada Ventures: https://news.crunchbase.com/startups/pitch-deck-mistakes-to-avoid-tefula-ada-ventures/

Streamline your startup pitch with Ada Ventures' AI review tool, AdaGPT.

Have I missed something? If you are a founder or investor in the region and you have some information that you would like to be included in this article, please contact me: briony@rocketmakers.com

At Rocketmakers we leverage our experience to build innovative software for companies of all sizes. If you have a vision for a project and you need a technical partner to help you design, develop and deploy it, get in touch: firstcontact@rocketmakers.com

Photo by Mathieu Stern on Unsplash